-

- 02 Mar

Real Capital – Why capital intensive industries like mining continually fail to achieve expected returns to investment

This paper is the first in a series examining the differences between real capital and financial capital. Not recognizing the differences between the two leads to incorrect investment decision-making and to failure to achieve expected returns to investment. In this paper I give an example of how to consider real options as part of the investment decision process, and how an investment opportunity that appears to have higher risk and higher return when considered from a total investment perspective can show a lower risk when considered from a real capital perspective.

Background

This paper is the first in a series examining the differences between real capital and financial capital. Not recognizing the differences between the two leads to incorrect investment decision-making and to failure to achieve expected returns to investment.

In this paper I examine real options, and how they relate to real capital. The paper highlights how poor treatment of a project’s ability or inability to change throughout its life is a primary cause of returns failing to live up to expectations.

An All-to-Common Story

In the 1980s, my family owned a limestone business just north of Gympie, Australia. We operated five quarries, and one of these was located right adjacent to the main highway. Like most open cut mines, we mined the shallowest ore first, but increasingly we had to remove more and more overburden to expose the limestone. So we hit on the idea that, instead of dumping this waste, we could just keep the better quality rock aside, and whenever there was an appropriate tender, we would crush it and supply it as top-course material for road construction.

Now envisage this: We were located right adjacent to the main road so we incurred very low transport costs. The rock had to be excavated anyway, so its marginal cost in this new application was practically nothing. We already had an under-utilized crushing plant on site, so we had similarly low costs of turning the waste rock into crushed and graded top-course material. And yet, in such tenders, we were routinely under-bid by someone else further away who thought he could beat our price with a dedicated plant set up just for the job. Invariably this competitor lost money or went broke. However the next time a similar tender was called some other bidder would emerge again with a lower price than us, probably using the same equipment purchased at fire-sale prices from the previous contractor … and this competitor too would go broke.

I don’t think we ever made any money from that side of the business the whole time we were doing it. There seemed to be a never-ending supply of lemming-like competitors who were intent on going broke competing against us. Economic theory, at least as it applies to many industries suggests that this sort of situation cannot be sustained, but it was going on 35 years ago, and practitioners from this industry know that it is still going on today. In fact it is going on in many other sectors of mining and in other capital-intensive industries. Why? Part of the answer has to do with real capital as opposed to financial capital and the way we evaluate investment decisions in these environments.

The problem stems from basic shortcomings in our understanding of capital and capital investment decision-making. It is the subject of my book Capital and Uncertainty. This paper looks at one element: namely real capital (as opposed to financial capital) and why poor differentiation between these two forms of capital has lead decision-makers astray. It also explains why the weighted average cost of capital is an inappropriate guideline for capital investment decisions, and why payback periods or “at risk” periods are critical elements in the investment assessment mix.

In a second paper in this series I examine asset values and the problem of asset write-downs which plague capital-intensive industry. Other papers look at risk and return and how these two concepts have totally different characteristics in the real capital world than they have in the world of financial capital. Elsewhere I also highlight some of the fundamental differences between capital investment decisions and the consumer goods decision-making of economic theory.

Capital

In economics there is probably no concept that has been subject to more confusion through time than the concept of capital. Writers extending from Adam Smith (1776) and Bohm-Bawerk (1921) have associated capital with something that yields value in the future, but typically such constructs have limited the definition to physical goods. Accounting standards have had a similar predilection towards physical goods. Using a value-based interpretation, the American economist Irving Fisher (1906) defined capital [as] “all wealth in existence, without exception of any kind.” Now with intellectual capital, reputational capital, brand names and the like, the real world is catching up to Irving Fisher.

“Capital” is the value, assessed in the present, attaching to something envisaged in the future. Whilst often associated with physical goods (capital goods) the value comes about only when these goods are combined with other resources, institutional structures and a plan within some market framework that together represent the ingredients to bring this future to realization. Mises (1966) was more explicit than Fisher, insisting that capital itself is “nowhere but in the minds of planning men”- a concept that is useful for an economist, perhaps, but not real helpful to a business practitioner.

Two important characteristics of capital follow from these value-based definitions:

- Capital is in “the minds of planning men”, but until interaction in a market setting one person’s plan cannot be presumed consistent with the plan of any other participant. Plans can be quite inconsistent, yet both parties, lacking knowledge of the other, can be valuing them under the assumption that the other doesn’t exist. This situation cannot occur with consumer choice where day-to-day market interaction continually aligns values at the margin. The “internal-to-the-firm” value may be quite different to the “market” value.

- Capital may be created or destroyed with no physical change. More knowledge can change capital (value) dramatically. The most value is frequently associated with processes that are least understood by the market, because only under these circumstances is competition likely to be weak or absent [and profits therefore potentially higher].

Beer barrels and blast furnaces, harbor installations and hotel-room furniture, are capital not by virtue of their physical properties but by virtue of their economic functions1. Something is capital because someone regards it as capable of yielding an income.

Capital investment choice is about the decision to bring into being these beer barrels and blast furnaces, harbor installations and hotel-room furniture. It is this process that bears closer examination.

Capital can be conceptually divided into two components:

- There is a component of value that is well recognized in the market place. For this component there is no difference between the owner’s valuation and the market valuation. A pick-up truck operating around a processing plant may be an integral part of the plant, but it is valued according to the market value of similar pick-up trucks operating anywhere else in the economy under the assumption of no transactions costs of substituting it for its alternative use. The pick-up truck, and other market-recognized assets such as working capital, are still “capital”, but their homogeneity in use mean that their value is independent of the success or otherwise of the overall investment plan of which they are a part.

- There are components of value that come about through proprietary knowledge or influences. These components are integral to the success of the plan. They represent the entrepreneurial elements of the capital, and their heterogeneity in use means that their value is directly dependent of the success or otherwise of the overall investment of which they are a part.

Broadly speaking, the first conceptual sub-division of capital represents financial capital. The second sub-division is real capital.

Consider first financial capital. In the financial capital world choices are made between alternatives that are part of a large set of possibilities, each set having uncertainty and expected return characteristics that can be defined and can be understood in aggregate terms. This is financial capital – Government bonds, traded shares, and currency instruments for example. Indeed, the value of any product in a well-defined, frequently traded market represents financial capital.

Choice in the real capital world is a choice between strategies – between alternatives that are very ill defined. To paraphrase Nobel economist Kenneth Arrow, the alternatives in the real capital world are characterized by the sequential nature of events; events that extend through time; and alternatives where the path chosen at one stage has an effect on choices at a later stage. Further, a choice at period 1 should rationally take account of the possibility that a second decision will be made in period 2 using information that is not known at period 1 but which it is known will be known by the time the period 2 choice is to be made (Arrow, 1958).

There is a huge difference in the treatment of financial versus real capital choices.

- Risk and return. With financial capital higher risk projects yield higher expected returns because with a large number of market participants, arbitrage arranges the opportunity set in such a way. With real capital there is no automatic relationship between risk and return because there are very few market participants (only one participant, usually) and no arbitrage.

- Information Availability. With financial capital, value is enhanced with better information generally available because this increases the size of the market, reduces uncertainty about choices and alternative choices, and improves the reliability of the risk-return relationship. Better proprietary information in the real capital world also enhances value by reducing uncertainty and reducing costs through elimination of unnecessary overdesign, for example. Better information generally available erodes the value of real capital because this increases the likelihood of competition eroding profit margins. With real capital higher-than-normal profit margins – economic rents – exist as a function of key information being proprietary and not available generally.

The errors being made in capital-intensive industry stem from the realization that almost all economic theory does not differentiate between the two forms of capital, but generally recognizes only financial capital. We use the tools derived for financial capital on choices involving real capital.

Indeed, the whole process of capital investment to make a profit is a process of taking financial capital – i.e., money, or something that can be readily turned into money – and turning it into some unique or heterogeneous form for some time. The processes is founded on the expectation that the output – when it finds its way into a market setting and when better information is then available – will be valued more than the [market] value of the original inputs.

The essential characteristic of an investment is that some or all of it is at risk or unavailable until at some time in the future. The decision to invest is a decision concerning the potential loss in value from when the entrepreneur “invests” (or dehomogenizes) his financial capital until he is in a position to recover it again in this form (i.e. usually, as money).

Financial Capital versus Real Capital

This section is an example of differentiating financial capital from real capital. The example is partially drawn from Chapter 15 of my book Mining Economics and Strategy, although in this book I didn’t use these specific terms. The example also introduces real options which are very closely related to real capital. Real options are the formalization of Arrow’s observation that choices at period 1 must take account of the possibility that a second decision will be made in period 2. The example which follows is rather artificial and very simplified, but is very easy to understand.

Assume you are considering the purchase of a new car. The purchase price is $40,000 and you are analyzing this proposed purchase in the same way as you analyze a major investment (in a mine or processing plant, or similar enterprise). The investment in the car has one great advantage over most other investments – at any time through the life of the car the market value can be readily established. This is a valuable aid to decision making that investors in idiosyncratic assets don’t directly enjoy. [There are indirect ways of determining the equivalent thing – even in advance – albeit with less certainty].

After due consideration you determine the value you expect to get from the car on a quarter-by-quarter basis for the next 5 years. You expect more value in the first year because the car is new: there is a novelty in driving it, and you will visit places that you have been putting off visiting. After the first year the novelty value will diminish and the value you will continue to derive comes directly from functionality. Table 1 sets out the quarter-by-quarter expected value including the re-sale value at the end of 5 years2. The amounts shown are net, after fuel, maintenance and other operating expenses.

Table 1 – Quarterly Value from Vehicle Usage

The funds put into the car will tie up your capital (or the monthly payments will inhibit other purchases) and these foregone alternatives are worth something to you. You estimate the opportunity cost of this capital over the 5 year ownership period is 7.5%. Applying a 7.5% discount rate to the amounts in Table 1, including the trade-in value, results in the net present value of the car to you of $41,183. Since the net present value exceeds the $40,000 purchase price, it is viable to proceed.

The quarter-by-quarter value received, and the cumulative value received is shown Figure 1, with the payback profile in Figure 2.

Figure 1 – Quarterly and Cumulative Value from Vehicle Usage

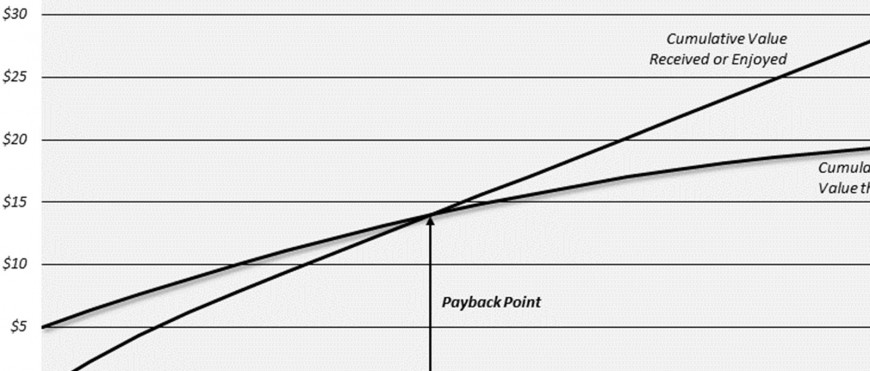

Figure 2 – Vehicle Purchase Payback Period, Conventional Approach

The conventional approach to this investment choice shows an internal rate of return of about 8.5% (the discount rate that yields a net present value of $40,000) and a 5-year payback period … you get your money back only after you finally sell the car. This approach tacitly assumes no scope for subsequent decision-making during the life time of the investment.

But the nature of capital investment choice is that decisions are not totally irrevocable, and you aren’t totally locked into a plan put together at the time you made the investment. You have an option (a real option) at any time to sell the car. By exercising this option you can change the payback profile at any time.

If you sold early, could you get your money back sooner? Figure 3 shows the estimated re-sale value of the car over the 5-year period.

Figure 3 – Vehicle Resale Value over Time

Anyone who has had to sell a fairly new car recognizes the large loss in market value initially. A similar problem exists with all large capital investments, usually due to transactions costs. Buying and selling a house, for example, typically results in 5% immediate loss – agency and legal fees, advertising and the like. Transactions costs are a burden even where all parties to the transaction value the product equally.

In this example, the day you drive the car out of the show-room, its market value drops by $5,000. Yet car sales are not subject to high transactions cost. Why then should there be so large a difference between the market value of a new car and the market value of a one-dayold car?

Many studies have examined this well-understood phenomenon3. It turns out that this is not primarily a transactions cost problem. Rather, the problem with motor vehicles and with most large capital investments is one of information asymmetry. If you valued the car at $40,000 (or more) on the day you drove it out, and no damage has been done to it, then your (private) value will not change. But “the market” does not know that no damage has been done to it. The engine might have had no oil! There is no way for an outside observer to know except by asking you. And you have an incentive not to tell the truth in the event that something did happen. This is an instance where the market price – for your car at least – is actually wrong because it is ill-informed.

Market-related trades occur daily, and when we make choices and engage in market interaction any difference between our valuation and the market valuation is at our risk. The real risk (the real decision) is not the total commitment on the vehicle purchase, but the difference between our value and the market value. In this example, we are exchanging $40,000 of financial capital (money) for our capital investment, which has two components:

- A car, the physical good, valued in the market place at $35,000 (initially) and the real option to exchange it for this market amount when and as required. This component is simply another form of financial capital, whose value is independent of the success or otherwise of the overall investment plan, and

- A plan to travel places, connected with a driver’s license, driving ability, and other private resources capable of bringing the plan to fruition. Upon realization of this plan we expect to gain $5,000 or more of value. This is the real capital component.

If something unexpected happens requiring plan revision, and we have to sell the car, the real capital component is the only part at risk. Initially the potential difference is quite large, but if the choice is a good one the value that is received over time increases at a faster rate than the market price of the investment decreases. The difference is relevant when, or if, the option to sell has to be exercised.

Figure 4 shows the cumulative value gained from use of the car, and the loss in value if at any time the option to sell bad to be exercised.

Figure 4 – “Payback” from a Loss-in-Value Perspective

Figure 4 puts an entirely different perspective on the investment decision. The true commitment at any time is the difference between the value lost in the event of sale and the cumulative value gained. After 2 years, the owner is in a position to sell the car, and the value received over the two-year period is equal to the loss in value on the sale.

Thus after two years the capital appears to be still “tied up” (de-homogenized, to use Lachmann’s term) in the car, but the owner is in a position to recover the capital in a ‘free’ form (that is: as money). The real capital is the maximum difference between the two lines leading up to the payback period.

This concept of payback illustrates, contrary to the common view, that there is not necessarily a strong correlation between discount rate and payback period. Decision-makers demanding payback in two years are usually thought of as quite risk-averse. However investments that yield a return of only 7.5% (or, in this case, 8.5%) are normally considered to be relatively low-risk.

A crucial element in this view of risk and real capital is how well-developed and wellinformed the market is. It is the market price, or more specifically, the ability to exercise some option to recover capital in a free form – that underpins the decision. If there is an independent market price (such as there is for second-hand cars) then this is ideal. For most firms with idiosyncratic investments, there is no such ready market. A proxy in the form of the market price of the firm’s securities has to suffice. Nevertheless, the same rules apply:

- For projects proceeding according to plan, the better-informed the market, the closer is the market valuation to the internal-to-the-firm value. This reduces the capital at risk, and reduces the time until payback.

- Markets also convey important knowledge that may not be available to a company’s own personnel. If the market judgment of the value of a project is different to the internal-tothe-firm value, then this may be due to knowledge that participants in the market at large have that the firm does not have. Companies ignore these market signals at their peril. But the market signals have less reliability if the market is ill-informed.

In the motor-vehicle example, only 12.5% of the total capital outlay ($5,000 out of $40,000) was initially at risk. From an investment perspective many standardized products in the market place exhibit similar proportions of investment capital at risk. But the availability of a vigorous market in second-hand goods does not automatically translate into lower risk choices, and the lack of availability of such a market does not automatically translate into higher risk choices. Nevertheless most mining investments, venture capital investments, and investments in intellectual property involve a very high proportion of real capital in the overall investment mix, and rational decision-making with respect to these investments demands more than just a superficial understanding of this issue.

Cost of Capital

All major investment decisions are preceded by a discounted cash flow analysis. The net present value is arrived at by discounting all of the expected project cash flows to some fixed starting point in time (usually: now) using the cost of capital as the discount rate. The “cost of capital” is usually thought of as being the weighted average cost of capital (or WACC). The WACC is defined as the expected return on a portfolio of all of the company’s securities – both debt and equity.

The logic behind applying the WACC to new project assessment is that a positive NPV will enhance the value of the company. A negative NPV means that the funds generated by the project are not sufficient to repay the funds invested in the project.

The capital structure of a firm, and the weighted average cost of capital, have received extensive treatment in the finance literature. Always stated, but nevertheless frequently overlooked in this treatment is the assumption of perfect capital markets. Provided a firm’s investment decisions are taken as given, and provided full information is provided to the market as soon as it becomes available (those who have the information sooner are not permitted to engage in market transactions), and provided that the trading in the firm’s securities is extensive enough, then the assumption of perfect capital markets is close to reality. But these are not the characteristics of any new capital investment!

Indeed, new capital investments can only be profitable if there is something about them that the “market” does not understand! Otherwise (in a perfect capital market) someone else would have developed them and/or similar projects, and captured the profit up until the point where for new projects, the expected profit is nil4. The NPV of the financial capital component of new projects should be nil because financial capital markets are as near to perfect capital markets as our current institutions allow. But the proprietary or real capital component of a project is an unknown, and undoubtedly demands a higher return than the weighted average cost of capital. The weighted average cost of capital is an outcome of successful projects whose risk and return characteristics are [then] well understood by the financial markets. It is incorrect to apply this benchmark to new (unproven) projects whose characteristics by definition could never be known by the financial markets until after the commitment to embark upon them has been made.

What then is the benchmark for assessing the worthiness of new projects? Determining the appropriate discount rate is far from a simple task, and not one that can be simply derived from analysis of a company’s existing securities. I provide a comprehensive example in my book Mining Economics and Strategy. From an economic perspective, the benchmark is the marginal cost of capital – the best return available from the last investment dollar placed in any other potential investment (including capital reductions).

From a finance perspective, the benchmark is also the marginal cost of capital, and this too is not independent of the project in question. The marginal cost of capital is the change in the total cost of capital, and if investment in project “A” results in changes in the cost of capital elsewhere in the company (even changes that might not materialize until later years), then the true marginal cost of the investment in project “A” has to take these changes into account also. Yet even this (true) marginal cost definition does not solve the problem of illinformed markets and the fact that most projects only exist because markets have not heard about them previously.

The correct marginal cost of capital from a source-of-finance perspective derives from how a well-informed debt and equity market views the project. Clearly at the start, outsiders have no view at all. Indeed, the best opportunities are available only when no-one else realizes they exist! Thus, the marginal cost of capital used for new-project DCF analysis has to be estimated. It is the owner’s expectation of how the project will be judged by the market once (the project) is performing, and once information is available for outside assessment. And the threshold expected return on investment for a particular project should include a premium for the additional risk a project bears until its performance can be realistically assessed and taken into account by market forces.

References

Akerlof, George A. (1984), ‘The market for “lemons”: quality uncertainty and the market mechanism’, in An Economic Theorist’s Book of Tales, Cambridge: Cambridge University Press.

Arrow, Kenneth J. (1958), ‘Utilities, attitudes, choices: a review note’, Operations Research, 5, 765-74; reprinted as Kenneth J. Arrow ‘Individual choice under certainty and uncertainty’, in Collected Papers of Kenneth J. Arrow, Cambridge, Mass.: Harvard University Press, 1984.

Bohm-Bawerk, Eugen von ([1921]1959), Capital and Interest, South Holland, Til.: Libertarian Press.

Fisher, I. ([1906] 1965), The Nature of Capital and Income, New York: A.M. Kelley

Lachmann, L.M. (1978), Capital and its Structure, Kansas City: Sbeed Andrews & McMeel.

Mises, Ludwig von (1966), Human Action, 3rd rev. edn, Chicago: Henry Regnery

Runge, I.C. (1998), Mining Economics and Strategy, Denver: Society for Mining, Metallurgy, and Exploration, Inc.

Runge, I.C. (2000), Capital and Uncertainty – The Capital Investment Process in a Market Economy, Aldershot, UK: Edward Elgar.

Smith, Adam, ([1776)1976), An Inquiry into the Nature and Causes of the Wealth of Nations, Oxford: Oxford University Press.

1Paraphrased from Lachmann (1978)

2There is no suggestion that this procedure even could be followed for a private motor vehicle whose value for most people derives from subjective criteria such as driving pleasure, status, and prestige as much as from savings in the value of their time or savings in bus or taxi fares. The example aims to illustrate the steps in the procedure for any style of investment.

3See: for example. Akerlof (1984).

4It could be argued that mining projects have a unique input – the orebody – that, unlike with much other industry, inhibits competitors from starting up in competition. However this argument overlooks the ready transferability of the ownership of orebodies in the market place. If the ownership of an orebody confers on the mining company some above-market economic benefit (economic rents) this can be captured by selling the orebody. The existence of a profit opportunity only exists with proprietary knowledge – about the orebody itself, or about how to exploit the orebody.

About the Author

IanRunge

https://ianrunge.com